A Houston Racketeering Ring of “Mini-Madoffs” Has Been Extorting Victims Out of Their Life Savings For Decades. The Syndicate Is Also Linked to a Tragic 2016 Murder-Suicide Involving Two Children.

PART I: MURDER AND FRAUD IN TEXAS

Lakshimanarayan “Lucky” Srinivasan, Jeremy Raju Srinivasan, Gwendolyn “Gwen” Stone Stallworth-Sumrall, Alvar Chari, Anirban Haldar and their many co-conspirators, have conned individuals, families, businesses and other organizations out of multiple millions of dollars in cash and assets over the past several decades, leaving many of their victims destitute and their lives ripped apart. The racketeering ring has used a combination of check-kiting, reverse Ponzi and other fraudulent investment schemes to extort money from their hard-working victims, court records show. In 2016, under mounting financial pressure caused by his and his co-conspirators’ volitional fraudulent entanglements, Jeremy murdered his wife and two young children before fatally turning the gun on himself. Lucky, Gwen and the others continue to actively seek new investors to swindle.

BY ALISSA FLECK & PHILIP FAIRBANKS

*Some names in this story have been changed where requested to protect victims’ identities. Their names are asterisked.

LUCKY SRINIVASAN, NATALIE ALTIER-SRINIVASAN, MJ SRINIVASAN, JEREMY SRINIVASAN (SOURCE: FACEBOOK)

Exactly five years ago today, on the morning of April 19, 2016, at 8:30 a.m., Jeremy Raju Srinivasan, 37, sent his father Lakshimanarayan “Lucky” Srinivasan a final text message: “Everything is not OK. Please call police. Goodbye.” What came next was a tragedy that would rock their quiet Houston, Texas suburb, leaving in its wake a trail of devastation and unanswered questions.

Within 15 minutes of sending that text message, Jeremy, his wife Natalie Altier Srinivasan, 35, and their two children, 5-year-old Sienna and 2-year-old Michael James (“MJ”), would be found dead by police inside their Katy, Texas home. One of the detectives who processed the scene, Detective Daniel Calvillo of the Fort Bend County Sheriff’s Department, told family members that Natalie was found in bed with a single bullet wound to the head. Jeremy had killed his wife, then shot each kid twice in the head while they lay asleep in bed, before turning the gun on himself.

SIENNA (PHOTO SOURCE: BILL ALTIER)

Police noted that they arrived at the Altier-Srinivasan home at 8:45 a.m., at which point Lucky had also arrived at his son’s house. Police went in through an open garage door, while Lucky waited outside.

LUCKY SRINIVASAN AND NATALIE ALTIER-SRINIVASAN (SOURCE: FACEBOOK)

Following the horrific crime, local news reports scrambled to explain how a seemingly happy suburban family that enjoyed going for long walks through the neighborhood, attending church, and watching Texas football games, could be wiped from this earth overnight. What, they puzzled, could prompt a father to take not only the life of his wife, but the life of 5-year-old Sienna -- who was vibrant, wise and loved to sing -- and 2-year-old MJ, who thought the world of his big sister? After all, a father is supposed to protect his children from the monsters, not be the monster himself.

MJ AND SIENNA (SOURCE: FACEBOOK)

The Srinivasans’ neighbors, whose kids regularly played with Sienna and MJ and even had a sleepover just a few nights prior, reeled at the news. Sienna was just about to turn six at the end of April. But those who knew Jeremy as more than a quiet, if sometimes withdrawn, presence around the neighborhood say there was something more sinister lurking behind the facade of the once-divorced father who spouted conservative values on social media and reveled in his gun collection, including the .38 caliber revolver he’d ultimately use to kill his family -- and that that final text message Jeremy sent to his father the morning he murdered his family, and the fact that Lucky was the last person to speak to his son on the phone the night before, offers up a significant clue.

A 2015 FACEBOOK POST FROM JEREMY SRINIVASAN (SOURCE: FACEBOOK)

Though Jeremy alone was responsible for executing his family, our investigation uncovered that Jeremy Srinivasan, his father, Lakshimanarayan “Lucky” Srinivasan, their co-conspirator Gwendolyn “Gwen” Stone Stallworth-Sumrall -- who over the years has served as a “secretary” for Lucky, among other roles, even often illegally “notarizing” documents for him according to witnesses -- and other family members and co-conspirators, including two men named Alvar Chari and Anirban Haldar -- have been extorting and defrauding individuals, families and the elderly (in Texas, the penalty for committing financial crimes against anyone over age 65, which qualifies as Elderly Abuse/Exploitation, doubles) as well as banks -- out of millions of dollars, for years, through a combination of check-kiting, real estate and reverse Ponzi schemes as well as other bogus investment opportunities.

A traditional Ponzi Scheme is a form of fraud that lures investors under the premise that their funds will grow from legitimate investing, and pays profits to earlier investors with the scheme with funds from more recent investors. The scheme leads victims to believe that profits are coming from legitimate business activity (e.g. product sales and/or successful investments), and they remain unaware that other investors are the true source of funds. What Lucky, Jeremy, Gwen, and their co-conspirators ran was more like a reverse Ponzi Scheme, wherein they lured investors over a slew of different investment projects, but never paid anybody back, and kept all the money for themselves.

We reached out to dozens of victims who lost substantial funds to Lucky, Gwen, Jeremy and their syndicate’s phony investment schemes -- so many that we decided to devote a series of articles to the ring’s swindles -- and there are almost certainly additional victims we still don’t know about. Some of the victims of Lucky’s gang’s many cons over the past several decades are now deceased, and it is too late for them to see justice.

Lucky, by all accounts the group’s ringleader and the one with the most prolific record of lawsuits filed and judgments entered against him, has between 30 to 50 bogus/forfeited business entities on file with the Texas Secretary of State, which were forfeited for non-payment of taxes according to the records on file with the office. Lucky typically listed Gwen, with whom the exact nature of his relationship is unclear, as anything from Director to CFO to Accountant on their myriad bogus business entities and shell companies.

Prior to 2012, Lucky and his co-conspirators defaulted on loans, and committed breach of contracts, with judgments entered against them at least 25 times, and at least 35 lawsuits filed against them in Harris County, Texas, alone, regarding loans, business dealings and investments totaling in excess of $11 million dollars. But it would take many more years for anyone to connect the dots on what the ring was doing, which, according to extensive court documentation and witness statements, was far from traditional, legitimate investment projects and loans.

It’s hard to tell if Lucky and his co-conspirators have ever run a legitimate business, or raised funds for a legitimate investment opportunity, but, perhaps most perplexing, sources agree, is this major question: "Where did all the money that they’ve stolen from their victims go?" None of the con-artists appears to currently enjoy a lavish lifestyle.

Though Gwen allegedly owns two houses, and Lucky was at one point known as a frequent fixture at Houston’s ritzy The Palm Restaurant, Lucky recently purchased a new house through a shell corporation he created, 10511 Timberoak Drive, LLC, in a feeble attempt to hide some of what’s left of the money and perhaps cover his tracks. Lucky’s house on Timberoak Drive is currently valued at more than $420,000, according to Houston real estate experts. Gwen’s houses are valued at more than $300,000 and $200,000, respectively.

THE DEED TO LUCKY’S TIMBEROAK DRIVE HOUSE PURCHASED THROUGH A BOGUS LLC

Most victims of Lucky's and his co-conspirators' fraudulent schemes have surmised that the vast millions of dollars they fraudulently obtained have been gambled away by Lucky, Jeremy and Gwen, while other victims believe that they have allegedly illegally laundered and hidden the money through family members or other co-conspirators in the USA, or in Lucky's home country of India.

FACEBOOK PHOTOS OF JEREMY SRINIVASAN’S GAMBLING PARTIES (SOURCE: FACEBOOK)

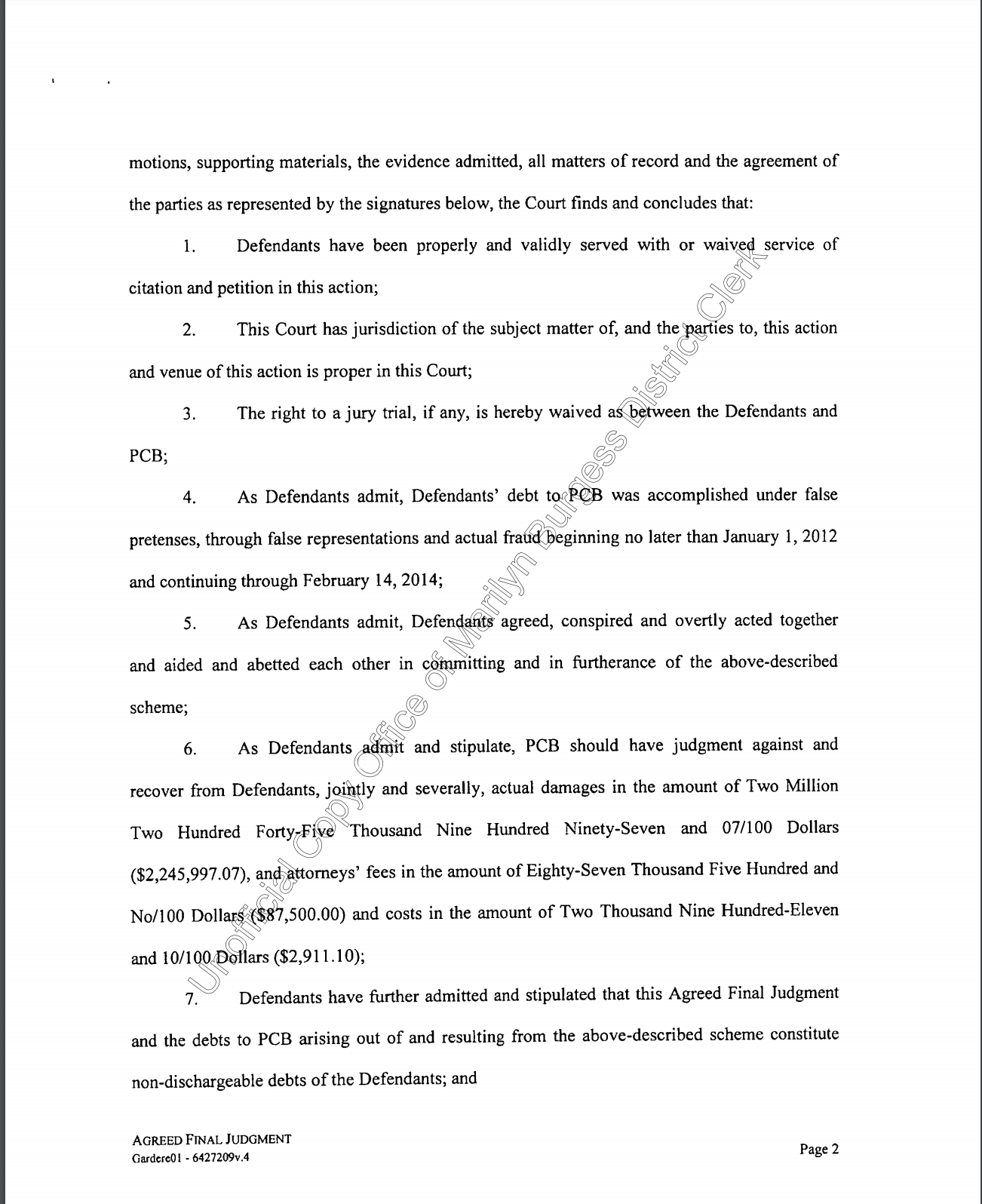

Since 2012, the cons have only ratcheted up, with Lucky and his gang even targeting a local bank with a check-kiting scam. In 2015, a judgment was entered in excess of $2.5 million dollars against Lucky and his co-conspirators by PlainsCapital Bank in which Lucky and the others admitted in a signed and notarized affidavit that they knowingly participated in fraud.

Our research has revealed the judgments against Lucky total somewhere between $11 million to a possible excess of $20 million dollars, and that is only including known lawsuits and judgments. It is our belief that Lucky has likely defrauded many more individuals and businesses, who did not bring suit, out of many more millions.

Between Jeremy, Gwen, Lucky, and Lucky’s late wife, Denise "Dee" Srinivasan, a former Mayor of the City of Hedwig Village -- a swanky, affluent suburb of Houston -- they have also filed for a cumulative seven bankruptcies in the state of Texas.

From some of the salt of the earth, this cadre of cons took until it hurt, and then they stole some more. Like the Bernie Madoff racket, it wasn't just individuals being held up by pen nib. At least one bank, we know of, was gobbled up by these con-artists' greed.

One of their more appalling cons according to sources included two of Lucky’s companies, Sterling-VA Marlin, LLC’s and Sterling Real Estate Development Trust’s (REIT) purchase, massive renovations, and capital investment in a shuttered VA Hospital located outside of Waco in Marlin, Texas, which was to be subsequently used as a rehabilitation center for returning US military veterans. Lucky was so bold as to attempt to extort money from Elizabeth Nelson, the former mayor of Marlin, Texas, for this specific project.

MARLIN, TEXAS VA HOSPITAL LUCKY, JEREMY AND GWEN DEFRAUDED INVESTORS INTO BELIEVING THEY’D TURN INTO A REHAB CENTER FOR RETURNING VETERANS

SHUTTERED MARLIN, TEXAS VA HOSPITAL

That “rehab center” never saw the light of day, and major project investor Gary Toy, and his immediate family, were defrauded of millions of dollars in cash and real estate holdings that they had put up as collateral for loans to purchase the acres of real estate and the shuttered VA Hospital, as well as other accompanying buildings located on the property.

Unlike with Bernie Madoff, these hustlers’ victims weren't just the fabulously wealthy. Many of them were lay investors who lost their life savings.

While the victims of the ring’s cons are shocked at how long the gang has gotten away with defrauding individuals and businesses alike, even more baffling they agree is why local, state and federal authorities have failed to take steps to thoroughly investigate and stop their ongoing fraudulent schemes in spite of all the information and documentation they have been provided.

MOUNTING FINANCIAL PRESSURE

In April 2015, just a year before murdering his wife and two young children, Jeremy attempted to file for bankruptcy in the Southern District of Texas Bankruptcy Court, but his case was thrown out by a federal bankruptcy judge. Included in Jeremy's bankruptcy documentation was evidence of three practically brand-new personal vehicles, with outstanding loans totaling in excess of $115,000. At the time, Jeremy was under mounting financial pressure from the collapse of various schemes in which he was involved with his father and Gwen, his house was being foreclosed on, and the landlord for the commercial business park where his business offices were located was in the process of conducting a lockout of his business.

JEREMY SRINIVASAN’S 2015 BANKRUPTCY PETITION

Jeremy and Natalie, a cosmetologist who devoted her time to caring for her two young children as well as strangers in the community who were down on their luck, grew up as neighbors in Houston, though both had gone their separate ways and were each once divorced when they finally ended up together, tying the knot in 2009.

Friends said Natalie found out they were about to lose the house, but there’s no evidence Natalie had any idea what Jeremy was involved in financially. Natalie’s father, Bill Altier, who was divorced by her mother when Natalie was 11-years-old and saw her sporadically throughout her teen and later years, but had reconnected with her shortly before her murder, said he never approved of Jeremy’s business dealings, and while he did once invest with Lucky in 1986, the deal fell through and he decided not to pursue any future investment opportunities with Lucky.

Bill recalls that in the months before Jeremy murdered his family, Natalie said Jeremy was drinking more heavily, which had begun to trouble her. Bill remembers Natalie saying she wished Jeremy would cut back on the drinking.

NATALIE, SIENNA, MJ, BILL ALTIER (SOURCE: BILL ALTIER)

At the time of this article’s publication, we did not hear back from Natalie’s mother. Natalie’s brother Michael respectfully declined our request to speak, citing the desire to grieve privately, but we did allow him to review the article’s contents beforehand out of respect to the family.

NATALIE AND SIENNA

“Lucky and Gwen may not have pulled the trigger, but they figuratively put the gun in Jeremy's hand and loaded it with bullets,” says one victim who lost his entire estate to Jeremy’s, Lucky’s and Gwen’s cons, and in late 2016 started investigating the family of fraudsters himself, doing basic due diligence he said his own attorney -- a close family friend of 25 years -- had never bothered doing himself.

Detective Calvillo, who investigated the Srinivasan murder-suicide, described Lucky’s demeanor when he arrived at the crime scene as “very unemotional and cold for just finding out his son was dead and grandchildren were murdered,” to an investigator after the case was closed.

SIENNA AND BILL (SOURCE: BILL ALTIER)

“That was the worst day of my life,” says Bill of finding out his daughter and grandchildren had been murdered. Bill takes comfort in the Scriptures when he recalls his bond with his daughter and grandchildren, he says. In particular, he recalls Sienna singing, which he says has “given [him] such great peace of mind” in light of his loss.

“My last visit at their Texas home, while Sienna, not yet six years old, [we] walked together along the pond as she fed the birds -- she sang with such a beautiful voice these words to me found in the book of Romans chapter 8 lines 38 and 39,” recalls Bill. He says reciting this passage, among others, brings him comfort every day: “For I am persuaded, that neither death, nor life, nor angels, nor principalities, nor powers, nor things present, nor things to come, [39] Nor height, nor depth, nor any other creature, shall be able to separate us from the love of God, which is in Christ Jesus our Lord.”

BILL, SIENNA, MJ (SOURCE: BILL ALTIER)

If Lucky’s unfazed demeanor at the crime scene wasn’t bizarre enough, Lucky had Gwen, his secretary and co-conspirator, pack up his son’s house and reach out to Natalie’s family to see what items of their daughter’s they wanted to keep. Jeremy’s brother, William Sethu Srinivasan was the named beneficiary on an insurance policy on Jeremy that paid out to the tune of $1 million dollars after his death, according to sources. It is believed that Jeremy had also taken out possible additional life insurance policies on himself and his wife that paid out up to $500,000 with William and/or Lucky listed as beneficiaries.

Lucky did not attend Natalie, Sienna and MJ’s funerals, and the Srinivasan name was left off their memorial plaque.

GRAVE MARKER (SOURCE: BILL ALTIER)

Bill Altier’s last conversation with Lucky happened approximately one year after the deaths of his daughter and grandchildren. As Bill pressed Lucky with questions about the murder, and in particular what Jeremy and Lucky had discussed in a cell phone call the night before, Lucky hung up on Bill. It was the last time they spoke.

Detective Calvillo, as well as the commercial business park landlord, told sources that when they went into Jeremy’s office, they found credit card debt and various loan documents that totaled into the hundreds of thousands of dollars or more. They also found specific loan documents from Jeremy and Natalie to a man named Robert Colmenares — a fellow tenant at Jeremy’s commercial business park — for about $100,000 that showed the Srinivasans had put their house up as collateral. The documents said Robert would get the house if the Srinivasans defaulted. Robert was initially interviewed by police as a person of interest in the murder-suicide due to the found loan documentation, though he was ultimately ruled out of any involvement in the crime.

BUSINESS RECORD FOR LUCKY’S COMPANY STERLING SYSTEMS LIMITED WHICH REMAINS ACTIVE

The U.S. Attorney’s Office for the Southern District of Texas has been made aware of Lucky’s bogus business dealings, as well as the local FBI office in Houston, and information and documentation has similarly been provided to the Securities and Exchange Commission (SEC), and the IRS. However, at the time of this article’s publication, these investigative federal agencies did not respond to a request for comment on any ongoing investigations.

Despite the toll years of financial fraud have taken on his life and family, including the loss of his son and grandchildren, Lucky Srinivasan, along with Gwen Stallworth-Sumrall and their co-conspirators continue to extort victims throughout the greater Texas area and continue to seek new investors for funds that will undoubtedly disappear, and for projects that will never see the light of day. The duo is still actively seeking funds for Sterling Systems International Inc.

BUSINESS PLAN FROM LUCKY AND CO.’S STERLING SYSTEMS INTERNATIONAL PRIVATE PLACEMENT MEMORANDUM

FROM THE STERLING SYSTEMS PRIVATE PLACEMENT MEMORANDUM

EMAIL FROM LUCKY SRINIVASAN TO A PROSPECTIVE INVESTOR IN STERLING SYSTEMS IN 2021, CONFIRMING THE ENTITY IS STILL SEEKING FUNDS

When we reached out to Gwen for comment, she asked us not to call her again and hung up on us twice. Lucky did not return our call requesting his comment on this story.

WHO IS LUCKY SRINIVASAN?

Lakshimanarayan “Lucky” Srinivasan was born in India in February 1949 to a family of wealth and influence. There are rumors that Lucky was responsible for an alleged murder in India as a teenager, and that in order to protect him, his family quickly and quietly swept him out of the country. Still in his teens, Lucky landed at UT Austin where he studied engineering.

DENISE “DEE” SRINIVASAN SOURCE: CITY OF HEDWIG

After making the move to Texas, Lucky married Denise “Dee” Anne Krause Srinivasan, a well-connected local woman from Jackson, Mississippi, who he met while attending UT Austin, ultimately adopting her daughter, Charise. It has been alleged by some sources that their marriage was a matter of convenience to accelerate Lucky’s filing for — and ultimate attainment of — American citizenship. Dee was the mother of Lucky’s two sons, William and Jeremy. In 2001, Dee became mayor of a wealthy enclave of Houston known as Hedwig Village.

SOME OF LUCKY’S BETWEEN 30 - 50 BOGUS BUSINESS ENTITIES ON FILE WITH THE TEXAS SECRETARY OF STATE

While evidence of Lucky’s early life in Texas is spotty, our research shows the paper trail of fraud and deceit for Lucky begins sometime around 1982, when both his engineering firm, LSA Engineers, Inc., and Lucky personally, were sued in Harris County District Court by Tri-Continental Leasing Corporation for Breach of Contract and non-payment of a rental agreement -- a judgment was taken in the amount of almost $10,000.

Lucky's penchant for not repaying debts soon became a comfortable habit, as the unpaid debts began to compound exponentially. In 1988, Prudential Insurance Co. of America brought a $1 million dollars judgment against Lucky and LSA Engineers Inc. for a breach of contract on nonpayment of an office space.

In the early 1990s, working alongside his wife and business partner Dee, Lucky then refused to repay Pacific Southwest Bank, located in Houston and Corpus Christi, nearly $4.5 million dollars. During that same time period Lucky declined to repay First Heights Bank nearly $2 million dollars he owed them. Adding to the multimillion dollar debts owed by Lucky during the same time period in the early 1990s, the Resolution Trust Corporation ("RTC") took over control of the Columbia Federal Savings and Loan Banks, and Lucky again refused to repay nearly $1.5 million dollars in outstanding debt and six loans/notes he owed and on which he had defaulted. (All of these lawsuits, judgments and abstracts are available for viewing on the Harris County District Clerk's and the Harris County Clerk's websites.)

JUDGMENT ENTERED AGAINST LUCKY IN 1993 BY PACIFIC SOUTHWEST BANK

JUDGMENT ENTERED AGAINST LUCKY SRINIVASAN IN 1990 BY THE RESOLUTION TRUST CORPORATION

FIRST HEIGHTS BANK JUDGMENT ENTERED AGAINST LUCKY SRINIVASAN IN 1993

Court records show that 1996 is the first year Lucky filed for bankruptcy, with Dee also filing for bankruptcy. In 1997, Dee became a city council member of Hedwig Village, before running for mayor in 2001 and again in 2003. Victims of Lucky’s cons say Dee knew what her husband was up to and was complicit in/benefited from the fraudulent real estate and loan schemes.

Dee died in 2005 from heart complications after a lengthy illness, according to her obituary. A release from the Texas State Capitol following her death described her as someone who “sought to strengthen the viability of Hedwig Village as a location for commercial development” with “much of her energies in office... dedicated to this end.”

Coincidentally, 2005 is when Lucky filed for bankruptcy a second time. Bankruptcy court records show that between Lucky and Dee, they filed for bankruptcy three times in a span of just nine years.

LUCKY SRINIVASAN’S 2005 BANKRUPTCY FILING IN SOUTHERN DISTRICT OF TEXAS

BANKRUPTCY FILINGS IN LUCKY SRINIVASAN’S NAME (SOURCE: PACER.GOV)

Lucky seemed keen on making fraud a family business and not even his wife’s terminal illness would stand in the way. Jeremy and Lucky’s other son, William Sethu Srinivasan, were both intimately involved and named as defendants in a major multi-million dollar breach of contract/loan default case (See: 4:03-CV-05071 -Vestin Fund II vs. Srininvasan, et al), a federal lawsuit in Houston which dragged on throughout 2004 and 2005, while Dee, by all accounts complicit in many of Lucky’s schemes, lay sick and dying in the hospital.

WHO IS GWEN STALLWORTH-SUMRALL?

Gwendolyn “Gwen” Stone Stallworth-Sumrall, who sources say prides herself on being a church-going, God-fearing woman, was born in 1956 in Pensacola, Florida, where she lived and attended school before making her way to Houston.

SOURCE: FACEBOOK

It’s unclear when or how Lucky and Gwen met, or the exact nature of their relationship over the years, but Gwen was also married while working alongside Lucky, to a man who died in 2017, and who sources say never liked Lucky and encouraged Gwen to abandon her business relationship with Lucky. By all accounts the warnings fell on deaf ears.

Federal Bankruptcy Court records show that Gwen filed for bankruptcy in 1997, 2006 and again most recently in 2017, while still retaining ownership of two houses.

Gwen inherited full ownership of one of her two homes -- her Houston house on Kleinway Drive, now valued at more than $200,000, from her husband via will probate after his death. She is also the owner, as of 2003, of a second home in Houston valued at over $300,000, which she’s allegedly leasing to a family member.

Even after her husband's death, Gwen continued to participate with Lucky in numerous fraudulent schemes and scams, most notably the Sterling Systems International, Inc. Private Placement Memorandum (PPM) and Sterling Systems LLC, where Gwen was, and is still actively listed as an Officer/Director/CFO, and which Lucky is still aggressively promoting as an investment project for unsuspecting victims.

Gwen is still similarly listed as an active Officer/Director for both Sterling REIT, Inc. and Sterling-VA Marlin, LLC, both known fraudulent business entities. Gwen also willingly participated, and allegedly shared in the ill-gotten gains, of the almost $3 million dollars that Lucky absconded with in the PlainsCapital Bank fraudulent check-kiting scheme.

THE VICTIMS

Jessica Chari was just 16-years-old when she met her first husband, Alvar Chari, 17, in 2000. Alvar started out flipping real estate to make money, says Jessica, beginning with houses and then moving on to larger plots of land in the Houston area. Alvar worked on real estate projects with his uncle Richard Vick in Costa Rica, as well as Lucky Srinivasan around the Houston area, though his main business partner at the time was a man named Anirban Haldar, according to Jessica. Though Alvar allegedly did a lot of business with Lucky, Jessica says she only met Lucky once or twice, in the early 2000s, but recalls, “I immediately got uncomfortable” in his presence.

“I didn’t like him right away,” she says. “You know when you meet people too eager to impress, just too slick and overly confident?”

“It’s hard to differentiate what deals Lucky was in and what he wasn’t involved in, because [Alvar and Anirban] had seven companies going,” Jessica adds.

She does recall that the men would often talk about rolling over money as equity for the next “bigger” deal to pad accounts, to explain away where the investor money was going, and why the family never seemed to be living as lavishly as expected from all the deals they had going on.

“Then the lavishness started,” she recalls. “We would have a new car every year, but it was never really ours...it was always on a lease program.”

Alvar had numerous business dealings throughout the 2000s, some involving Lucky and others that did not. Jessica -- who remembers her husband’s lifestyle as full of fancy dinners, vacations to Cancun and schmoozing -- says Alvar repeatedly emphasized that certain business dealings were to be kept from others, which sometimes seemed to extend even to her. Jessica’s job was to entertain the investors and their wives. Around that time, the deals were getting bigger and bigger, from flipping single homes to flipping as many as 50 lots.

Early on though, Jessica saw red flags. “I knew all the investors, they’d have dinner together, they’d congratulate us when kids were born, our kids attended the same schools. But if we went to dinner with people some people weren’t allowed to talk about deals, Alvar constantly reminded me to keep things confidential.”

“I was also not comfortable with his partner [Anirban], but that was not an option,” she says, describing how Alvar grew increasingly controlling and manipulative of her.

“During that time I was in nursing school and we had two children together, so I was raising kids and thinking he’s building a real estate company -- cool,” says Jessica. “Things would strike me as odd, but it was always ‘no offense, honey but you don’t understand how things work,’ I assumed maybe it was true when he called me “small town.’”

But when the real estate bubble burst in the U.S. in 2008, Alvar moved Jessica and their kids to Costa Rica where he led her to believe his real estate business was booming.

But life in Costa Rica was not at all what Jessica had expected. When they moved there, the capital city they lived in was nothing like the beautiful seaside tourist town they had visited when Alvar first tried to persuade her of the move. Alvar also kept Jessica sequestered inside their home, under the security of two full-time armed bodyguards, and Jessica ended up needing to get kidnapping insurance for her two young kids. The whole thing felt surreal. She knew something was way off about her husband’s business dealings and she wanted out, but Jessica was also a young mother, alone in a foreign country, and scared for her life.

Jessica describes how she slowly became bilingual, learning Spanish from a bodyguard so she could begin to eavesdrop on Alvar’s increasingly shady-appearing business dealings with the random men who would drop by the house, or mysteriously show up in a taxicab when the family was out and about.

During this time Jessica came to learn that Alvar, Anirban and their co-conspirators were defrauding honest investors back in Texas, taking money investors had earmarked for land development or real estate flipping, and funneling it into a strip club in Costa Rica. The investors Jessica had come to know and befriend back in Texas were being defrauded and robbed while Alvar and Anirban laughed behind their backs, she says.

Alvar and Anirban defrauded one couple, who were awarded a $980,000 judgment against them. The couple says they never saw any of the money.

JUDGEMENT ENTERED AGAINST ANIRBAN HALDAR AND ALVAR CHARI FOR THE FRAUDULENT USE OF INVESTOR FUNDS

One day Jessica, then 22, walked into her husband’s office in Costa Rica -- a place she was forbidden from going -- and saw men un-taping stacks of cash from Anirban’s chest. He’d just returned from an overseas trip. It was the final straw for Jessica. When she saw the money strapped to her husband’s partner’s chest, it dawned on Jessica fast that she and her children had been dragged into something wholly sinister, and it was time to get out.

It was right around this time that Anirban assaulted Jessica, showing up at the family’s door one day and punching her square in the face. The very next day Jessica fled Costa Rica for Texas with her toddler daughter, who had recently fallen ill. On that plane ride back from Costa Rica, Jessica learned Alvar had drained their bank accounts, leaving her with nothing. When she arrived home in Texas, she found she was locked out of their house, which she soon learned had never belonged to them in the first place.

In a panic, Jessica called the family’s CPA only to learn he’d never heard of her, and that the family hadn’t filed taxes in almost eight years. It would be another seven weeks before Alvar would bring their son back to the U.S., and only because Alvar was forced back after being caught on an illegal passport.

Jessica remains, in many ways, under Alvar’s thumb legally speaking. As a term of their divorce agreement, for which Alvar never showed up in court and which took place over the phone, Jessica is not able to legally change her last name for ten years and their kids are not allowed to hold passports.

According to federal business documents, Alvar Chari currently lives and works as an independent contractor in West Fargo, North Dakota, where he’s in the “Carpet and Upholstery Cleaning Services” industry.

As of this article’s publication, Anirban appears to still be actively involved in real estate, and is still listed on several companies. In fact, Anirban has approximately 15 businesses listed with the Texas Secretary of State, many of which appear to be “active” business entities.

“Neither [Alvar nor Anirban] seems to have gotten out of the game,” says Jessica. When we reached out to Anirban for comment on this story, he denied hitting Jessica and hung up on our journalist. Alvar did not respond to a request for comment on this story at the time of publication.

In 2010, *Mason Hunter’s mother unexpectedly passed away. Before her death she had formed a trust for Mason, who had moved back home. Mason's personal friend of 25 years, attorney *Roger Z. (Mason declined to give his real name for publication) was put in place as Trustee once the matter was probated at the end of 2011.

It was then that Roger first mentioned Lucky Srinivasan, an alleged successful client of his and alleged developer in Houston. “I thought, well, you’re the expert, you’re the trustee, you’re a licensed Texas attorney” explains Mason. “I didn’t think three steps ahead that if he’s a client and I’m a client, that’s a conflict of interest.”

Mason also expected that his attorney/trustee, Roger, had conducted due diligence on Lucky, as was his legal obligation. In Texas, a trustee's duties include “the use of the skill and prudence which an ordinary, capable and careful person would use in the conduct of his own affairs.”

The duty of competence also encompasses many “sub-duties,” one of which is the duty to comply with the “prudent investor rule.”

Mason recalls going to meet Lucky and Jeremy in Houston for the first time. “Lucky is very smooth,” he says. “He comes across as extremely professional.” The duo appeared confident, but not pushy. Lucky is short in stature, and Jeremy stood looming behind his father. “They had all these ideas…” says Mason, describing some of the projects Lucky and Jeremy presented, including electronic billboards in China and prefab homes in Afghanistan.

Lucky and Jeremy also presented Mason with a photo album showing before and after pictures from other supposed buildouts and reconstructions they’d done. It all looked impressive enough.

Lucky, Mason recalls, was “unabashedly unafraid” to “play the sympathy card” about his wife’s death seven years prior, and her supposed “deathbed wish” to have Lucky “fulfill his dreams.” Lucky said he wanted to bring to "fruition and completion" his various investment projects to honor her wishes and carry on the memory of his deceased wife. Mason didn’t know then that summoning sympathy over Dee’s death was just one weapon in the arsenal Lucky regularly used to defraud unsuspecting investors, or even that Lucky and Dee, while she was still alive, had already swindled so many others out of millions of dollars.

FOR SALE SIGN OUTSIDE LUCKY’S, JEREMY’S AND GWEN’S W. 34TH ST OFFICES

The pair, along with Roger, ultimately encouraged Mason to invest in the renovations of a main office and buildout of an area directly adjacent to their office building -- a warehouse area directly behind/attached to their 5014 W. 34th Street offices in Houston. Lucky and Jeremy would never build out nor renovate the main offices and warehouse space with the funding they received through Mason. It was eventually foreclosed upon and put up for sale

Not knowing the Srinivasans had no intention of making ever good on their proposed projects, after that initial meeting, between 2012 and 2015, Mason made a number of additional investments and loans with/to Lucky and his associates.

In October 2013 Lucky released an "official" Private Placement Memorandum (PPM) for a company called Sterling Systems International, Inc. In the year leading up to the PPM, Lucky repeatedly told Mason that company Director Ron F. Bearden -- a professor Lucky was known to name-drop when a project demanded clout -- would be helping raise investor funds, along with Lucky’s own son, William Sethu Srinivasan.

Lucky bragged to Mason that William would find funding and investors through his private equity/real estate/investment fund based in Dallas, Texas, called Lantern Asset Management (the same one that bought Harvey Weinstein's bankrupt companies), of which William was one of the founding partners. Lucky also told Mason that a renowned doctor would be investing in Sterling Systems, though in actuality the doctor he was referring to was dealing with the devastating fallout of Lucky’s check-kiting scheme. Still operating under the belief that his attorney/trustee Roger had done due diligence on Lucky, Mason put his property up as collateral for Lucky to get a loan.

Around this time, without Mason’s knowledge, Lucky and Jeremy took Mason's money that supposedly had been specifically ear-marked for the Sterling Systems International, Inc. project (“Project Greenlight”), and was supposed to be used at the 5514 W. 34th Street offices, business, and warehouse location, and instead took the money and opened up offices/warehouse space for “LED Lights of Texas LLC” at a commercial business park located outside of Houston.

“I didn't know about Jeremy's other business and office location until after his suicide,” says Mason.

In the summer of 2014, Lucky again borrowed additional funds from Mason to the tune of $100,000 to finish the supposed buildout of a building and offices located on the same property and directly across the driveway from Lucky's , Gwen's and Jeremy's main offices and warehouse, the same office space Lucky also borrowed money from another man named Alan Tang to complete. As was Lucky’s M.O., he made sure the two men had no idea about each other until it was much too late. Alan was also defrauded by Lucky and a co-conspirator named David Lucyk, and Alan eventually sued both of them and their respective business entities, obtaining a judgment.

Lucky and Jeremy would never finish the buildout and renovation of the office space area, ultimately selling the property and building, and never disclosing to the buyers the loans made on the property, nor ever repaying those loans in excess of $200,000. To this day, Lucky continues to conduct business with the buyer of that land, Tina Nguyen, a local bookkeeper, CPA, and real estate investor on various projects with Lucky.

Lucky and Jeremy allegedly made representations to Tina Nguyen that if she bought the property (unfinished building and offices), they would assist her as paid consultants in obtaining the proper permits and contractors to finish out the office space. After paying the Srinvasans monthly consulting fees for approximately six months — tens of thousands of dollars — with no work being done by the Srinivasans, Tina Nguyen finally dismissed them, eventually selling the building and property to Allen "AL" Almassi.

In summer 2015, Mason got on a conference call with Lucky and his attorney and trustee Roger, asking for his money back and for his property to be released as it had been going on nearly three years that Lucky, Gwen and Jeremy had his money, and his property locked down for collateral, with no real development.

“Lucky said he was working with a bank, Green Bank, and he would get a loan from them to pay me back,” says Mason. “Of course I found out much later on that he could not possibly get a loan from any bank because of the PlainsCapital Bank check-kiting judgment and other prior lawsuits and judgments, totaling in the millions of dollars that had been brought against Lucky, Gwen and Jeremy, and their myriad of bogus business entities that I was never informed about.”

From August 2015 to April 2016, Lucky told Mason still he was working on getting a loan through Green Bank to pay him back to get the liens off of his property being used as collateral. “But of course he comes up with all kinds of excuses for not getting done or finalized,” says Mason. “Then April 2016 comes and Jeremy murders his family and commits suicide.”

In late September 2016, Mason was informed there was a foreclosure proceeding filed against his property because Lucky had defaulted on making approximately three months’ worth of payments on the loan, on which they had used Mason’s property as collateral. Mason decided to look into Lucky himself, doing the due diligence he’d already reasonably expected his attorney Roger to have conducted.

What Mason found in less than a day horrified him.

UNRAVELING THE CONS

When Mason entered Lucky’s name into the Harris County District Courts and Harris County, Texas County Clerk’s webpages on his home computer, 49 cases came back, with nearly all of them being lawsuits that had been filed against Lucky, his wife Dee, or their companies, including numerous judgments and abstracts of judgments on file.

Mason discovered that Lucky had defaulted on numerous loans and had numerous breach of contracts in excess of $1 million dollars each. The lawsuits and judgments he found against Lucky that pre-dated 2012, when he first met Lucky, eventually totaled in excess of $11 million dollars. These were lawsuits and judgments that his attorney/trustee had never researched and never conducted due diligence on, never informing Mason about Lucky defrauding people out of multiple millions of dollars.

There were never any legitimate real estate or other types of investment projects. None of what Lucky had represented to him was real, and it was becoming clear Mason wouldn’t be getting any of that money back. Mason had been funneling his own money right into Lucky’s pockets, along with untold others, and nobody but Lucky was seeing the payout.

Among the judgments entered and lawsuits filed against Lucky was the signed and notarized affidavit in which he, Jeremy and Gwen admitted they had participated in a check-kiting scheme.

SIGNED AND NOTARIZED CHECK-KITING AFFIDAVIT FROM 2014 WITH LUCKY, JEREMY AND GWEN’S SIGNATURES

SIGNED AND NOTARIZED CHECK-KITING AFFIDAVIT FROM 2014 WITH LUCKY, JEREMY AND GWEN’S SIGNATURES

SIGNED AND NOTARIZED CHECK-KITING AFFIDAVIT FROM 2014 WITH LUCKY, JEREMY AND GWEN’S SIGNATURES

SIGNED AND NOTARIZED CHECK-KITING AFFIDAVIT FROM 2014 WITH LUCKY, JEREMY AND GWEN’S SIGNATURES

“What completely destroyed me and broke my spirit was that I saw PlainsCapital Bank filed a lawsuit in February 2014 and I’m sitting there thinking, that’s when they got more money from me -- I pulled up the case and read the very detailed and graphic lawsuit petition and saw that it was a multimillion-dollar check-kiting scheme,” recalls Mason. “And Lucky and Gwen and Jeremy just readily and flippantly admitted that they had knowingly and willingly committed fraud… they admitted they committed a bank robbery with a pen... when I saw that I was like, oh my God, I walked outside and I literally threw up...I continued to dry-heave for what seemed an eternity.”

Through his digging into judgments against Lucky, Mason learned he was far from the first to be conned by the man and his co-conspirators. And he would not be the last. Before he ever met Lucky, legal records Mason came across online revealed Lucky and his co-conspirators had already conned others out of millions of dollars in cash and assets.

Had his attorney/trustee Roger conducted basic due diligence on Lucky, Mason explains, he would have easily found the myriad fraudulent schemes and bogus business entities Lucky had concocted and participated in prior to recommending him to Mason or others, potentially saving multiple victims from destitution. (Investor Gary Toy had also been represented by Roger and as per Roger’s recommendations, he and his family had invested in Lucky’s doomed-to-fail VA Hospital renovation in Marlin.)

While some who were duped by Lucky and his cronies have been eager to speak out, others have been more reluctant to speak, which is sometimes the case for victims of white-collar crime who may feel embarrassed that they fell for the ruse in the first place. Lucky is also a pro at making others look complicit, sources say, in some cases by telling lay investors they were signing traditional investment documents, while in actuality he’d be using their information to take out loans in their name.

“In commercial real estate, there can be an attitude that if you get burned by somebody, then you’re at fault,” Mason explains.

The more we dug into Lucky Srinivasan, the more people we found whose lives had been ripped apart by his deviancy and his ability to easily charm and seduce even the highly intelligent, educated and socially well-connected. There is no one from whom Lucky is not willing to steal, and no con too depraved.

Today Lucky lives in a house on Timberoak Drive in Houston, which he purchased using a promissory note through his bogus business entity filed in September 2019 named 10511 Timberoak Drive, LLC. It’s believed Lucky used the shell company to purchase the house so it cannot be seized based on a judgment against Lucky in his own name.

Lucky, Jeremy and Gwen have stolen from widows, orphans, the elderly, military veterans and untold others. Mason, who never personally dealt with Anirban nor Alvar, calls Lucky, Dee, Jeremy and Gwen “financial terrorists,” and describes their behavior as “psychopathic” and “sociopathic.” “They are pathologically lying con-artists -- they are mini-Bernie Madoffs and Allen Stanfords,” he says.

One woman who, along with her partner, lost between $5 million and $8 million dollars -- their entire nest egg -- to Lucky, Alvar and Anirban’s cons, says Lucky has “zero conscience.”

Jessica Chari, by all accounts a victim of the ring of grifters herself, says she is coming forward with her story to help all the innocent victims defrauded by her ex-husband and his co-conspirators, and to help preserve the memory of Natalie and her children who did not deserve to die the way they did.

"Lucky Srinivasan would steal from the collection plate at a church if he could get away with it — that is how much of a depraved, degenerate, devious and sick individual he is…” says one victim. “Lucky’s, Jeremy’s and Gwen’s fraudulent machinations contributed to the murders of three innocent family members, and yet after the murders, Lucky Srinivasan and Gwen Stallworth-Sumrall just kept right on going with the same types of scams and schemes they’d been doing for decades. They have no scruples, no moral compass."

THIS IS PART I OF A MULTIPLE PART INVESTIGATION; SUBSCRIBE TO CRIME SCOOP FOR THE UPCOMING RELEASE OF PART II.

IF YOU HAVE ANY TIPS RELATED TO THIS INVESTIGATION, PLEASE CONTACT US BY EMAIL. YOU MAY REMAIN ANONYMOUS.